Innovation and Brand Recognition

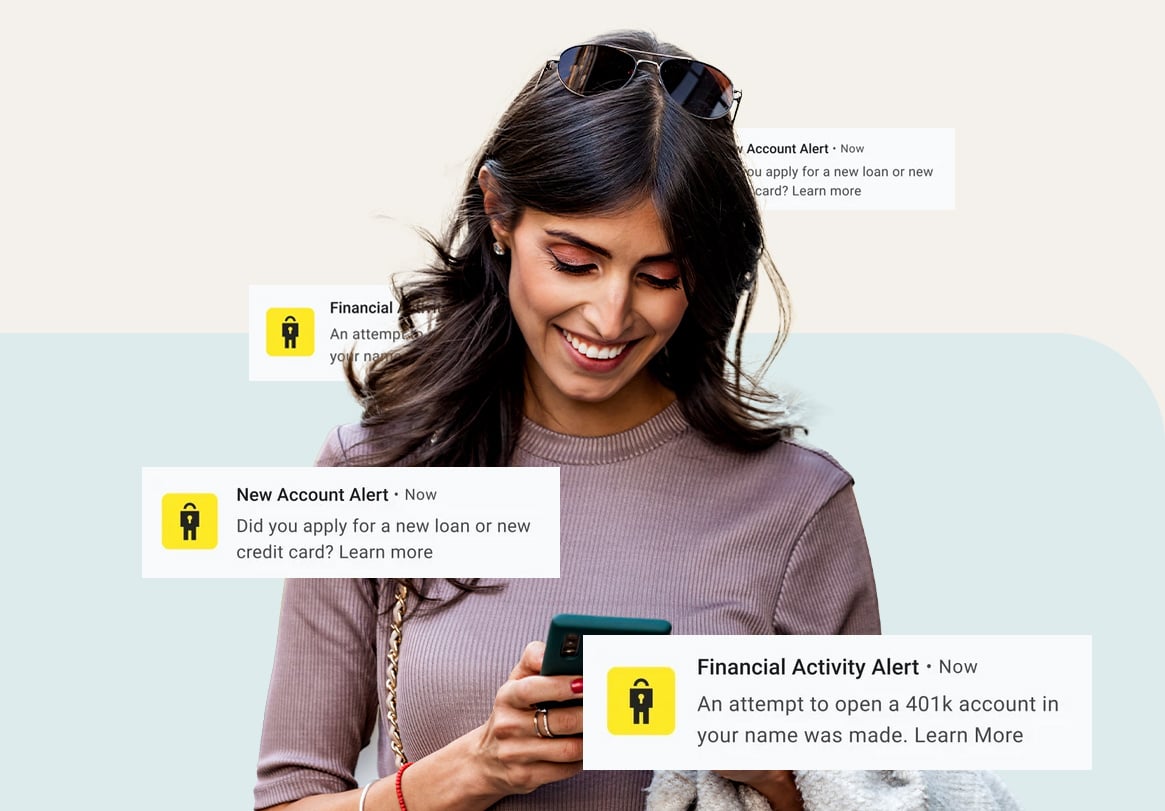

We combine the power of LifeLock, a pioneer in identity theft protection, and Norton’s four decades of consumer cybersecurity to help protect employees and their families. We commit to enhancing our products, because we know that your employees deserve industry-leading protection.